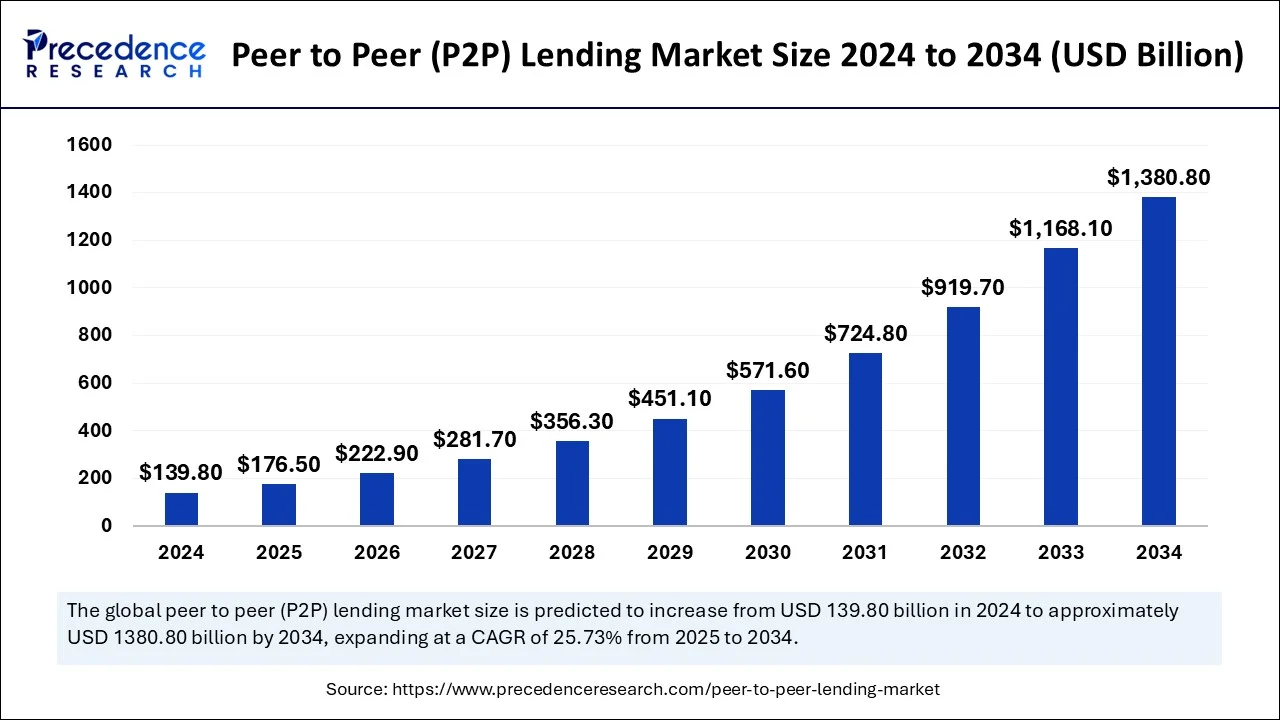

Peer-to-Peer (P2P) Lending Market Size to Exceed USD 1,380.80 Billion by 2034 Driven by Digitalization and Fintech Adoption

The global peer-to-peer (P2P) lending market size is projected to grow from USD 176.5 billion in 2025 to over USD 1,380.80 billion by 2034, registering a remarkable CAGR of 25.73% during the forecast period. Growth is primarily driven by accelerating digitalization, fintech innovation, and the rising demand for alternative financing models that bypass traditional banks.

Ottawa, Sept. 05, 2025 (GLOBE NEWSWIRE) -- According to Precedence Research, the global peer-to-peer (P2P) lending market size was valued at USD 139.80 billion in 2024 and is projected to surpass USD 1,380.80 billion by 2034, growing at a solid CAGR of 25.7% from 2025 to 2034. The peer-to-peer lending market is driven by rising demand for alternative financing, digitalization, higher investor returns, and reduced dependence on traditional banks.

Peer to Peer (P2P) Lending Market Overview

What is Peer-to-Peer Lending?

Peer-to-peer lending (P2P lending) is a digital financial service model that bypasses the middlemen in the form of traditional banks by connecting borrowers and investors directly through online services. It offers borrowers access to funds in time and at low interest rates and makes investments attractive to investors compared to other traditional savings or investment options.

The growth of the P2P lending market is impacted by expanding internet penetration, increasing need to tap other sources of funding, cheap lending applications, and the transition of the global financial service industry to digital services. P2P lending is a disruptive and viable funding model because financial inclusion will be a global issue and change the lending landscape worldwide.

Peer to Peer (P2P) Lending Market Highlights

- In terms of revenue, the peer-to-peer (P2P) lending market is projected to attain USD 176,500 million by 2025.

- The market is projected to achieve nearly USD 1,380,800 million by 2034.

- The market is expected to grow at a double-digit CAGR of 25.73% from 2025 to 2034.

- The U.S. dominated the North American market by holding more than 63% of the market share in 2024.

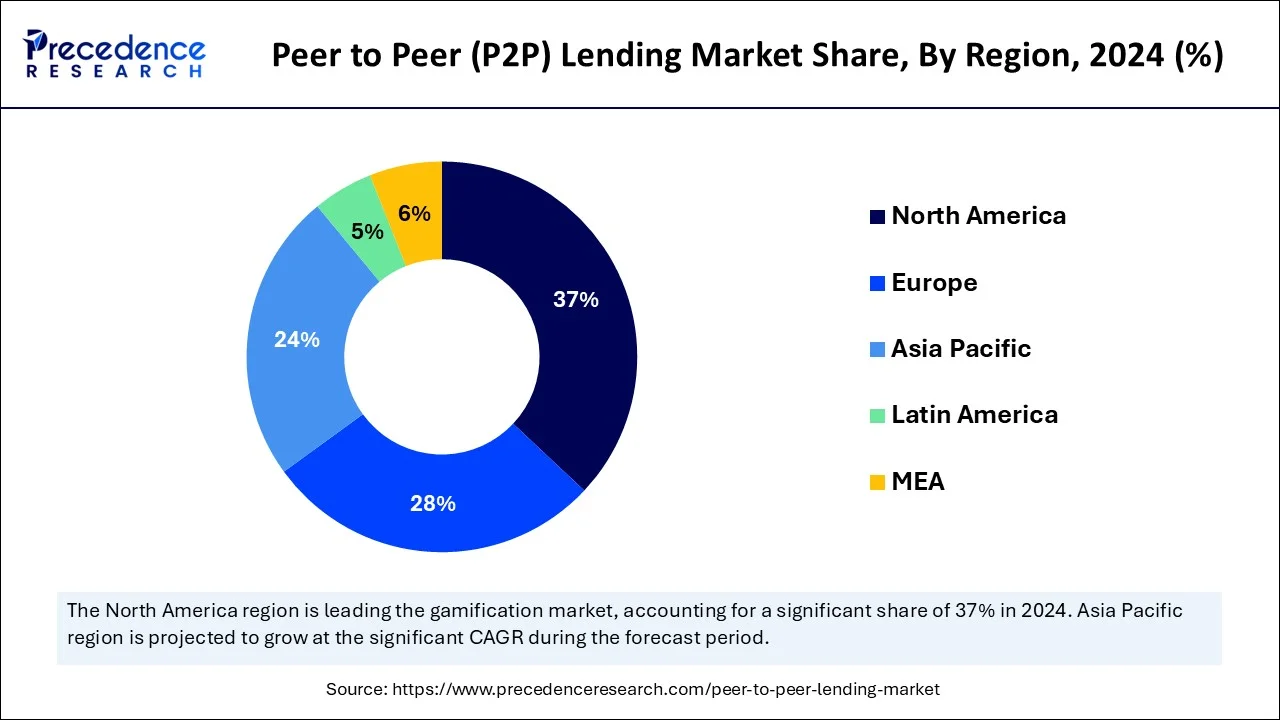

- North America accounted for the largest market share of 37% in 2024.

- The Asia Pacific is expected to expand at a strong CAGR of 25.52% from 2025 to 2034.

- By business model, the marketplace lending segment is projected to experience the highest CAGR from 2025 to 2034.

- By type of loan, the consumer lending segment captured the highest market share in 2024.

- By type of loan, the business lending segment is expected to grow with the highest CAGR between 2025 and 2034.

- By Business model, the traditional lending segment contributed the highest market share in 2024.

- By business model, again, the marketplace lending segment is anticipated to grow at the fastest CAGR from 2025 to 2034.

Peer to Peer (P2P) Lending Market Size Analysis from 2025 to 2034

The peer to peer (P2P) lending market size will grow from USD 176.5 billion in 2025 to USD 1,380.80 billion by 2034, with an expected CAGR of 25.73% from 2025 to 2034.

Peer to Peer Lending (P2P) Market Size by Type 2022 and 2024 (USD Billion)

| Type | 2022 | 2023 | 2024 |

| Consumer Lending | 55.2 | 69.5 | 87.6 |

| Business Lending | 32.8 | 41.3 | 52.2 |

Peer to Peer Lending (P2P) Market Size by End User 2022 and 2024 (USD Billion)

| End User | 2022 | 2023 | 2024 |

| Consumer Credit Loans | 31.0 | 39.0 | 49.2 |

| Small Business Loans | 23.5 | 29.6 | 37.4 |

| Student Loans | 19.1 | 24.0 | 30.1 |

| Real Estate Loans | 14.4 | 18.2 | 29.4 |

Peer to Peer Lending (P2P) Market Size by Business Model 2022 and 2024 (USD Billion)

| Business Model | 2022 | 2023 | 2024 |

| Marketplace Lending | 38.7 | 48.8 | 61.5 |

| Traditional Lending | 49.3 | 62.1 | 78.3 |

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/1651

Top Trends in the Peer-to-Peer Lending Market

- AI & Machine Learning in Credit Scoring: Platforms are increasingly using artificial intelligence (AI) algorithms to assess borrower risk profiles more accurately and in real time.

- Blockchain for Transparent Transactions: Blockchain technology is being integrated to enhance transparency, reduce fraud, and automate smart contracts.

- Rise of Niche Platforms: Specialized P2P platforms targeting specific borrower segments (e.g., students, SMEs, green projects) are gaining traction.

- Integration with Fintech Ecosystems: P2P lending is increasingly being bundled with digital wallets, neobanks, and robo-advisors for seamless financial services.

- Institutional Participation: Hedge funds, banks, and institutional investors are participating in P2P lending markets, increasing liquidity and platform credibility.

- Cross-Border Lending Opportunities: Globalization of P2P lending platforms is enabling cross-border investments and lending, especially in emerging markets.

-

Regulatory Tightening: Governments are introducing stricter compliance standards to protect investors and borrowers, influencing platform operations.

Peer to Peer (P2P) Lending Market Opportunity

Growing Emergence of Social Impact Investing:

The peer-to-peer lending market is well-positioned to exploit the growing sphere of social impact investing, where funds are invested in projects that will generate measurable positive social impacts, on top of financial gains.

P2P sites can recover money by pairing borrowers with lenders who are socially conscious about investing in projects such as small businesses in underserved/marginalized regions, renewable energy initiatives, educational programs, or microloans to small business owners in developing countries. As the sustainability and ethical investing trend gains popularity across the globe, P2P lending websites that offer impact-oriented opportunities can attract a new category of investors and may stand out in the market.

View Detailed Insights@ https://www.precedenceresearch.com/peer-to-peer-lending-market

Peer to Peer (P2P) Lending Major Challenges

Concerns Associated to Credit Risks:

The peer-to-peer lending market faces such a barrier that credit risk would be concentrated when a platform is excessively exposed to a number of borrowers, sectors, or geographic locations. This type of concentration can make them very susceptible to external shocks such as economic crunches, changes in policies within the region or industry-specific problems. Without adequate safeguards, credit risk concentration is likely to reduce platform resilience, constrain the involvement of investors, and reduce long-term expansion.

Peer to Peer (P2P) Lending Market Key Regional Insights

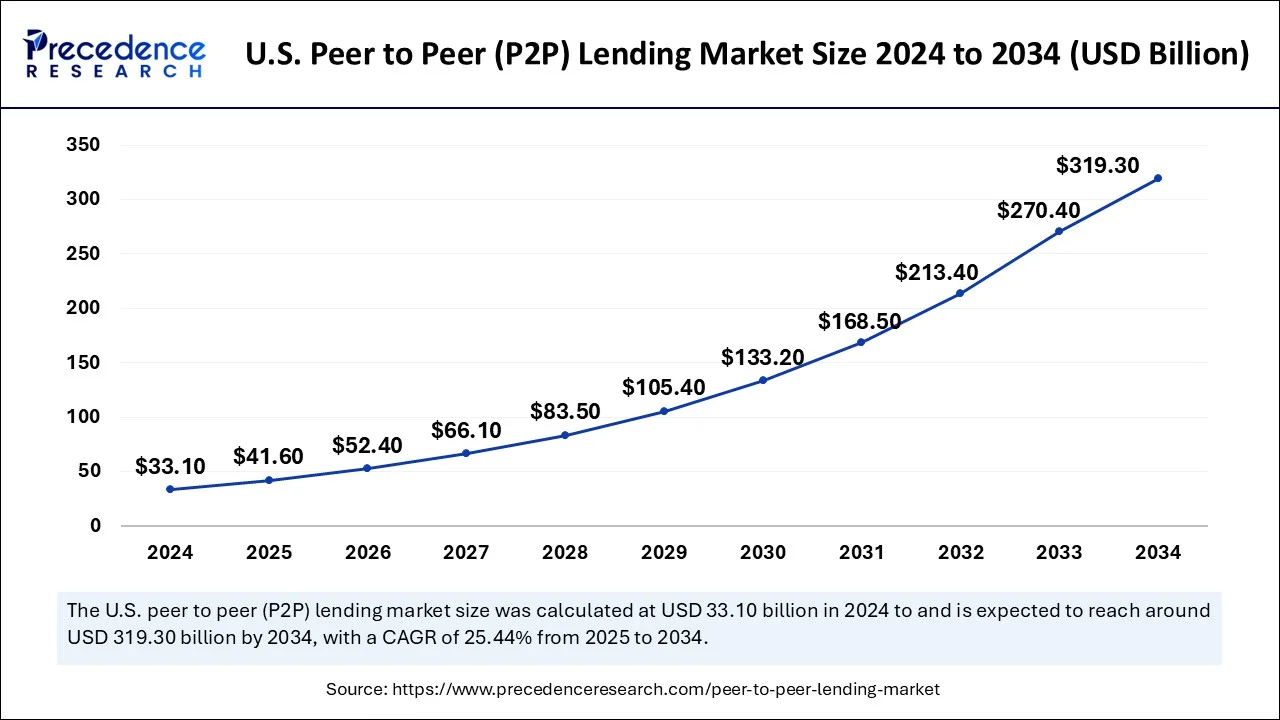

How Big is the U.S. Peer to Peer (P2P) Lending Market?

The U.S. peer to peer (P2P) lending market size is valued at USD 41.60 billion in 2025 and is anticipated to reach approximately USD 319.3 billion by 2034. The industry is expected to expand at a notable CAGR of 25.44% from 2025 to 2034.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Try Before You Buy – Get the Sample Report@ https://www.precedenceresearch.com/sample/1651

How North America Dominated the Peer-to-Peer Lending Market?

North America dominated the peer-to-peer lending market in 2024, due to the presence of established fintech companies, high digital adoption, and strong investor fuel market expansion. Moreover, widespread awareness of alternative lending solutions and the region’s emphasis on financial inclusion strengthen P2P lending adoption. All this has seen North America become a market leader, which is able to provide a safe and efficient environment that promotes further innovation and a high level of participation by institutional and individual investors.

Asia-Pacific Peer-to-Peer Lending Market Trends:

Asia-Pacific experiences the fastest growth in the market during the forecast period, due to the high pace of digitalization, robust SME development, and government-supported financial inclusion efforts. China is the region’s leader in terms of a massive P2P lending environment, and India demonstrates high potential as people start using cashless payment options and digital lending platforms more.

The increasing population of small and medium-sized businesses in need of alternative financing services has produced a boom in the demand for P2P sites. The government action in the developing economies, including positive policies towards fintech and digital lending, has stimulated growth.

Peer-to-Peer Lending Market Segmentation Analysis

Type Analysis

Why did the Consumer Lending Segment Dominate the Peer-to-Peer Lending Market?

The consumer lending segment dominated the peer-to-peer lending market in 2024, due to the increasing demand to borrow small and easy personal loans. P2P sites are being used to consolidate borrower debt, purchase improvements to their homes, pay medical bills, and fund their education. These sites are attractive to the younger generation and people with non-standard credit histories because their application procedures are less complicated, less documentation is required, disbursements are faster, and their interest rates are competitive with traditional banks.

The convenience and accessibility of the P2P lending model have rendered consumer loans the most prevalent category because it enables borrowers to overcome the barrier of the traditional lending framework and allows investors to generate returns consistently.

The business lending segment is the fastest-growing in the market during the forecast period, as small and medium-sized enterprises (SMEs) seek to adopt P2P platforms more to access funding. With fintech platforms creating better risk assessment models and designing business-friendly loan products, SME entry is going to skyrocket. As governments in emerging economies facilitate entrepreneurship and the use of digital finance, lending in the P2P platforms will grow as one of the main triggers of innovation and economic growth in the lending sector.

End User Analysis

Which Application Segment Held the Largest Share of the Peer-to-Peer Lending Market?

The consumer credit loans segment held the largest share in the peer-to-peer lending market in 2024, due to the scheduled payments, which offer more predictable returns to the investors due to low rates of default. Its predictability and wide borrower base, which consists of both individuals trying to borrow to cover lifestyle costs and those trying to supercharge existing debt.

Moreover, consumer credit loans tend to have smaller loan values and less time to terms, minimizing the risk of any financial derailment. Consumer credit loans remain the most validated and most commonly used application in the global P2P lending market due to the ease with which thematic approval processes can be performed through digital platforms.

The student loans segment experiences the fastest growth in the market during the forecast period, due to the escalating cost of education and high-level education demands across the world. Students in developing regions are seeking other sources of financing since they cannot access traditional bank loans. A more flexible, accessible, and faster solution can be provided with P2P systems, where the documentation requirements are less and the conditions are more favourable.

The longer payback periods make student loans attractive to lenders because the loans tend to ensure a steady stream of income. Moreover, around the world, the loans to students are partially backed or subsidized by the government, thus reducing the risk of default and enhancing investor confidence.

Business Model Analysis

Why did the Traditional Lend Segment hold the Largest Share of the Peer Lending Market?

The traditional lending segment held the largest share in the peer-to-peer lending market in 2024, because it is the simplest and most trusted model. Under this arrangement, platforms are merely intermediaries who bring borrowers and lenders together without becoming the holders of loans or lending themselves. This noted decrease in the usage of financial intermediaries is appealing to investors and borrowers who do not want to be tied to the traditional banking networks. Also, this model is easy and therefore users can scale, meet regulatory requirements, and keep costs effective.

The marketplace lending segment experiences the fastest growth in the market during the forecast period. Technological development and the involvement of institutional investors are expected to drive the marketplace lending segment. Another method of enhancing credit scoring, fraud detection, and tracking repayment to reduce risks and optimize efficiency is artificial intelligence and advanced analytics. With the increasing demand for global digital lending solutions, there will be a great increase in marketplace lending, and marketplace lending will become a technologically developed and investor-friendly model in the changing P2P lending environment.

Top Companies in the Peer-to-Peer Lending Market

The Peer to Peer (P2P) Lending Market is dominated by key industry leaders whose strong market share and strategic initiatives shape the future direction of the industry.

- Avant LLC

- Zopa Bank Limited

- Funding Circle

- Social Finance Inc.

- Kabbage Inc.

- RateSetter

- Lending Club Corporation

- Prosper Funding LLC

- LendingTree LLC

- OnDeck

Recent Developments:

- In January 2025, LenDenClub began providing a daily earning loan product, which will include lenders earning daily interest as well as the lender repaying their principal. Nine-month loan tenures will allow the initiative to increase investor flexibility and introduce a unique income model, as well as add more innovative solutions through which LenDenClub can operate within the competitive market, making up P2P lending.

- In December 2024, Defender Global launched its new P2P lending platform and raised $235,000 to use in real-world projects. As an asset-based and easily accessible investments enthusiast, the site tries to take advantage of the increasing demand of the world to enable the investor, and become a disruptive threat in the peer-to-peer market of lending market.

- In October 2024, IndiaP2P introduced its Monthly Income Plan-Plus, in accordance with the new settlement rules of the RBI. The scheme would allow the lenders to receive returns of up to 18 per cent annually, with monthly payments that will provide them with a steady stream of income and allow them to build investor confidence and compliance.

Peer to Peer (P2P) Lending Market Segments Covered in the Report

By Type

- Consumer Lending

- Business Lending

By End User

- Consumer Credit Loans

- Small Business Loans

- Student Loans

- Real Estate Loans

By Business Model

- Marketplace Lending

- Traditional Lend

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

Thank you for reading. You can also get individual chapter-wise sections or region-wise report versions, such as North America, Europe, or Asia Pacific.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/1651

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

Stay Ahead with Precedence Research Subscriptions

Unlock exclusive access to powerful market intelligence, real-time data, and forward-looking insights, tailored to your business. From trend tracking to competitive analysis, our subscription plans keep you informed, agile, and ahead of the curve.

Browse Our Subscription Plans@ https://www.precedenceresearch.com/get-a-subscription

About Us

Precedence Research is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.

Web: https://www.precedenceresearch.com

Our Trusted Data Partners:

Towards Healthcare | Towards Packaging | Towards Automotive | Towards Chem and Materials | Towards FnB | Towards Consumer Goods | Statifacts | Towards EV Solutions | Towards Dental | Nova One Advisor | Market Stats Insight

Get Recent News:

https://www.precedenceresearch.com/news

For the Latest Update Follow Us:

LinkedIn | Medium | Facebook | Twitter

✚ Related Topics You May Find Useful:

➢ The global contactless payment market size was USD 48.37 billion in 2024, calculated at USD 56.11 billion in 2025 and is expected to reach around USD 213.39 billion by 2034, expanding at a CAGR of 16% from 2024 to 2034.

➢ The global digital lending platform market size was calculated at USD 10.91 billion in 2024, and is projected to hit around USD 13.8 billion by 2025, and is anticipated to reach around USD 114.72 billion by 2034. The market is expanding at a solid CAGR of 26.53% over the forecast period 2025 to 2034.

➢ The global micro lending market size accounted at USD 212.42 billion in 2024 and is anticipated to reach around USD 541.02 billion by 2034, expanding at a CAGR of 9.80% between 2025 and 2034.

➢ The global P2P payment market size was valued at USD 3.07 trillion in 2024, and is projected to hit USD 3.63 trillion by 2025, and is anticipated to reach around USD 16.21 trillion by 2034, growing at a CAGR of 18.10% from 2025 to 2034.

➢ The global fintech as a service market size was calculated at USD 358.49 billion in 2024 and is expected to reach around USD 1,620 billion by 2034. The market is expanding at a solid CAGR of 16.28% over the forecast period 2025 to 2034.

➢ The global decentralized finance market size accounted for USD 21.04 billion in 2024 and is predicted to increase from USD 32.36 billion in 2025 to approximately USD 1,558.15 billion by 2034, expanding at a CAGR of 53.80% from 2025 to 2034.

➢ The global FinTech blockchain market size was calculated at USD 0.48 trillion in 2024 and is predicted to hit around USD 21.59 trillion by 2034, expanding at a notable CAGR of 46.31% from 2025 to 2034.

➢ The global smart contracts market size accounted for USD 2.02 billion in 2024 and is predicted to increase from USD 3.69 billion in 2025 to approximately USD 815.86 billion by 2034, expanding at a CAGR of 82.21% from 2025 to 2034.

➢ The global neobanking market size accounted for USD 148.93 billion in 2024 and is predicted to increase from USD 230.55 billion in 2025 to approximately USD 4,396.58 billion by 2034, expanding at a CAGR of 40.29% from 2025 to 2034.

➢ The global smart contracts in the renewable energy market allow seamless automation of clean energy exchanges with minimal human intervention.

➢ The blockchain’s role in the crypto market enhancing security, transparency, and innovation across DeFi and digital currencies.

➢ The global cryptocurrency mining market size accounted for USD 2.45 billion in 2024 and is anticipated to reach around USD 8.24 billion by 2034, growing at a CAGR of 12.90% between 2024 and 2034.

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.